The Only

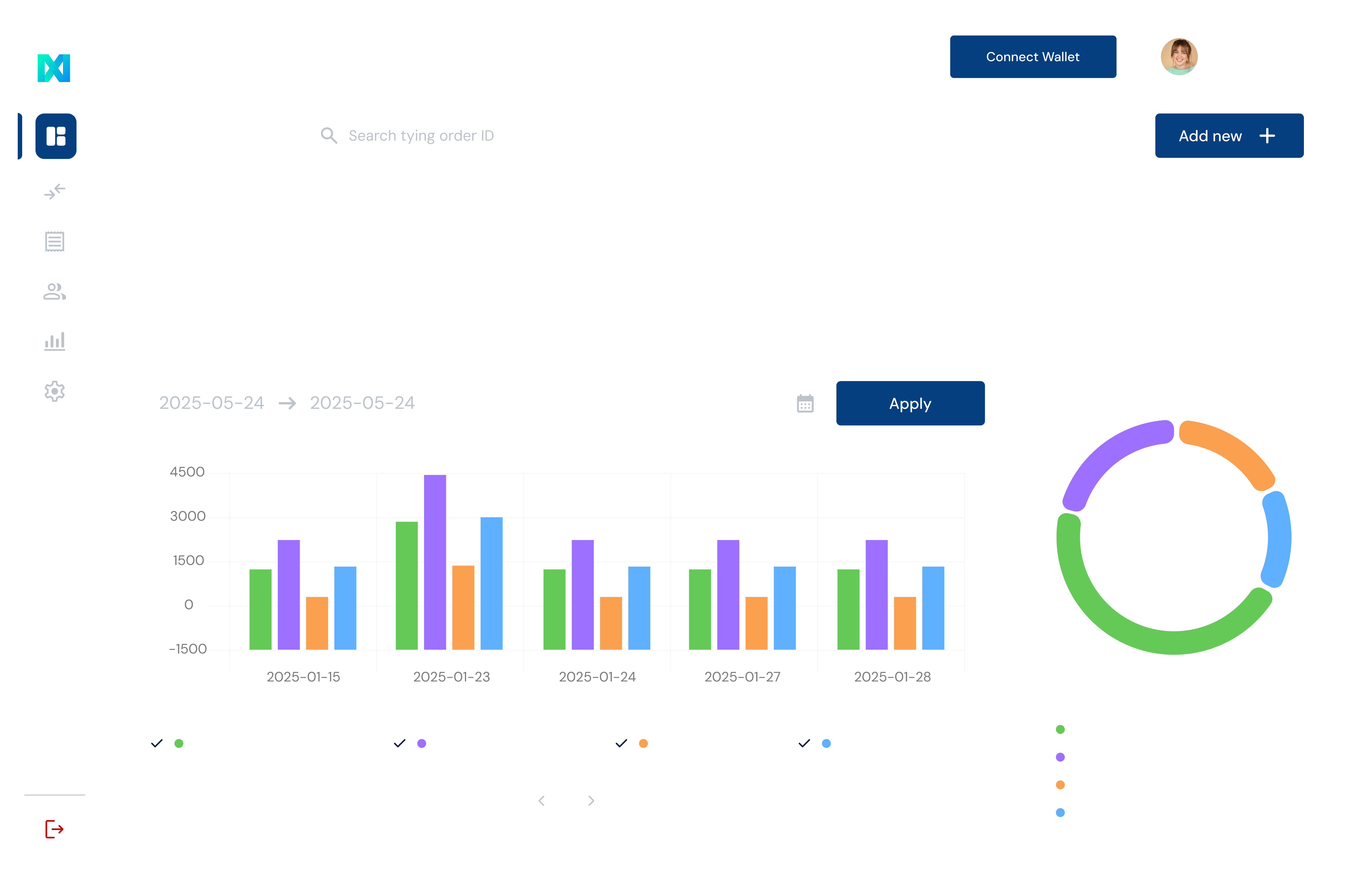

Fully On-Chain Loan Origination Platform

Unbanking Shipping marks the first step in integrating blockchain technology with traditional finance.

The Industry

The shipping industry is a capital-intensive business complicated by its multi-jurisdictional nature. The fragmented and opaque nature of the industry makes it ripe for innovation, and a natural field for blockchain application.

We aim to disrupt the financial transmission mechanism on the operating expenditure side starting from the bunkers market using blockchain technology.

The Market

The international shipping industry, using various specialized types of vessels, is responsible for approximately ninety percent of world trade. The bunkers industry provides the fuel needed to operate these vessels.

The global bunkers fuel market is currently estimated to be 229 million metric tons per annum, with the current bunker fuel price of around USD650 per metric ton valuing the market at approximately USD150bn per annum. This is forecast to grow with a Cumulative Annual Growth Rate (CAGR) of c. 5%, reaching USD200bn per annum by 2031.

Nexum Platform has already onboarded a number of traders with an aggregate annual turnover up to USD3bn. The bunkers market is a highly fragmented and opaque market, with a significant portion of the market being transacted on a bilateral basis. The bunkers market is a key component of the shipping industry, with bunker fuel costs representing a substantial part of the operating costs of a vessel.

The Technology

Win blockchain as its core, Nexum simplifies operation nd unlocks new loyalty and payment possibilities.

The Platform

Regulatory Compliance

The Process

The average funding period of a bunker supply invoice is c. 25 days. Under US law Buyer invoice represents an in-rem senior claim against the vessel, effectively securing the Platform's lending against a real asset.

Bunker invoices effectively have money market debt instrument characteristics, with historically minimal risk of non-payment. The Platform disburses up to ninety percent of the Supplier invoice amount and has other remedies at its disposal against the trader that further enhance the credit worthiness of the receivables.

The financing amounts advanced to the Supplier and collected from the Buyer are unaffected by oil price risk, leaving the Platform exposed only to Buyer credit risk.